Net Pay Finder

Simplify Your Salary Calculations with Net Pay Finder Calculating your basic salary using only your net pay and other salary components after deductions can be complex. Thankfully, Net Pay Finder simp

·

2 min read

Follow these steps to use the Net Pay Finder on the ERpxpand website:

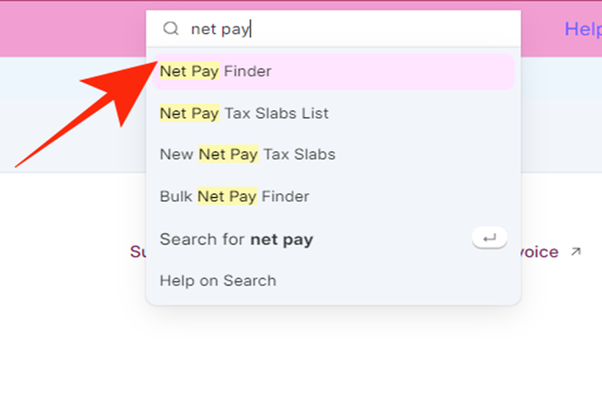

- Login and Search:

- Login to your ERpxpand app.

- Type “Net Pay Finder” in the search box to locate the tool.

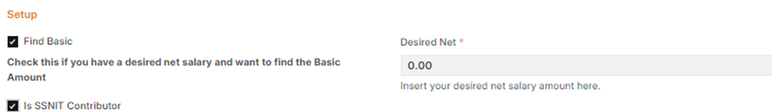

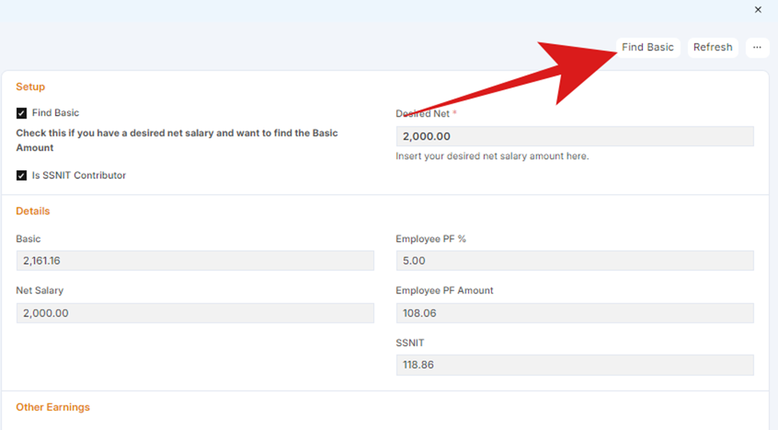

- Setup

- Tick the option to “find basic” salary and input the net salary amount in the “desired net” box .

- Select whether the employee is a SSNIT contributor.

- Enter PF provided by employee either in percentage or amount if any.

- If SSNIT was selected earlier, the SSNIT amount will be automatically generated.

- Other Earnings:

- These refer to additional income an employee receives on top of their regular salary. This can include accommodation, vehicle benefits, non-cash benefits, and taxable or non-taxable cash allowances.

- Fill in the relevant details for other earnings.

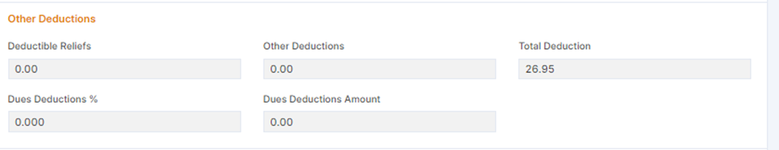

- Other Deductions:

- These are non-tax deductions subtracted from an employee’s gross pay, such as union dues and contributions.

- Enter the details in percentages or amounts as applicable.

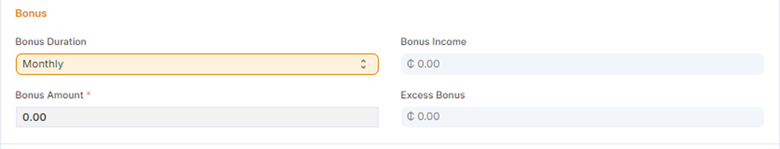

- Bonus:

- A bonus is additional compensation given to an employee on top of their regular salary. This is subject to taxes and deductions where applicable.

- Select whether the bonus is monthly or yearly and fill in the relevant sections, especially the bonus amount.

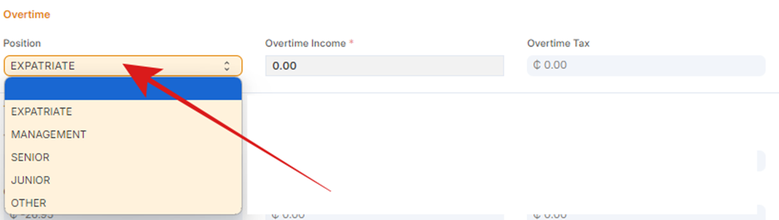

- Overtime:

- Select the employee’s position, and the overtime income and tax will be automatically calculated. Please note that overtime tax is only calculated if the employee is a junior staff member, and their salary is below 1,500. However, if the position of the employee is not “junior” or if salary exceeds 1,500, then the overtime income will be added to the taxable allowance and taxed as PAYE.

- Calculate To Find Basic Salary:

- Click on “Find Basic” in the top right corner of the page to determine the basic salary.

- You will receive a prompt, and the basic salary will be the “Basic” box.

Note: To reverse the process, where the basic amount is known and the net amount needs to be calculated, enter the basic amount in the designated box and add any applicable components. The net amount will be automatically calculated.

By following these steps, you can easily calculate your take-home pay and gain a clearer understanding of your earnings and deductions. Happy calculating!

No comments yet. Login to start a new discussion Start a new discussion